More than 66% of a finance team’s time is spent on transaction processing and control activities

The traditional letter of credit process is fraught with inefficiencies and risks. This is due to its reliance on the manual handling and matching of numerous types of documents that often results in errors, delays, or worse, missed payments. Data often comes in unstructured formats from various sources, making extraction and processing both time-consuming and resource-intensive. Intelligent data reconciliation with embedded AI helps you better manage your global trade finance risk.

(Source: APQC)

Leading organizations are using AI to digitize and automate critical processes, separating themselves from their peers

Effective resource utilization on what matters

63%

Fewer FTEs in transactional roles

Operational efficiency

37%

Lower transaction processing cost as a percentage of revenue

Focus on value-added activities

60%

More analytical time focused on proactive decision-making, rather than historical reporting

Above are industry benchmarks from The Hackett Group, highlighting benefits of industry leaders versus peers.

"We have an initiative underway to eliminate the lengthy, manual tasks around our long-form oil contracts. Additionally, due to the dramatic volume growth in our business, job satisfaction was also decreasing, which we needed to address. We are working with ClearDox to automate the 3-way matching and reconciliation of these complex documents. This has allowed us to speed up the processing of the documents and just focus on exception handling, while also delivering greater data accuracy with a digital single source of truth. The implementation was minimally disturbing to our existing workflows, which accelerated adoption across the team."

Geetika Arora

Director, Head of North America Oil Contracts, Freepoint Commodities

Using AI to enhance the speed and reduce risk in your trade finance

Improve margins | Business scale | Reduce operational risk

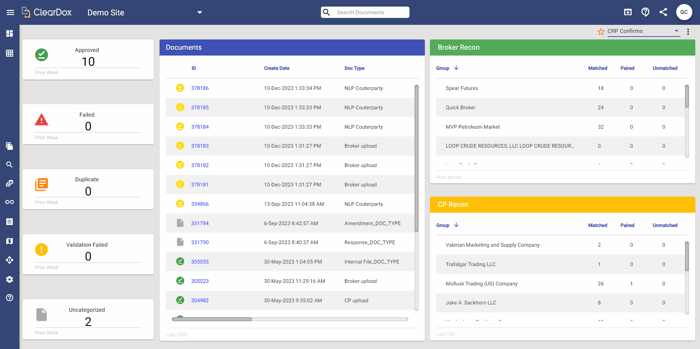

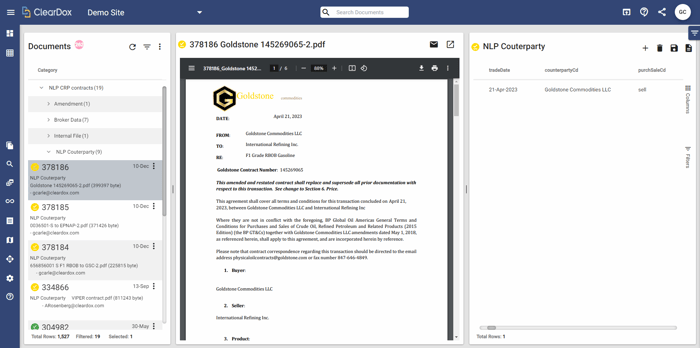

- Centralized role-based dashboards streamline document management for LoCs, with all inbound documents and their statuses displayed for easy tracking and management.

- Action items are clearly defined, allowing users to quickly address LoCs that are approved, pending approval, or require attention due to errors or duplicates.

- The system offers configurability and user-defined setups, catering to specific roles within an organization for efficient document oversight.

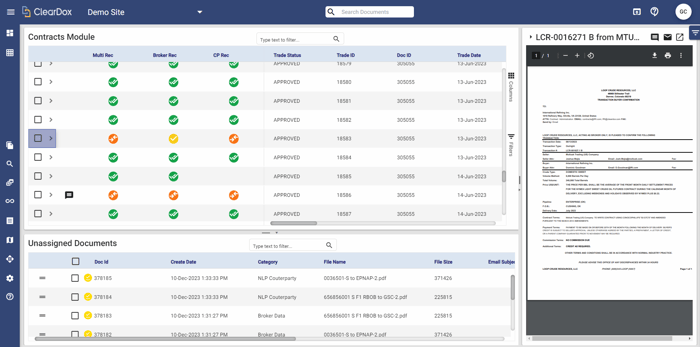

- ClearDox's Multi-Source Reconciliation Engine reconciles external documents from various sources with the LoC terms, ensuring conformity and reducing delays.

- The reconciliation process is built on robust system-configured pairing and matching logic with an embedded workflow for accepting or rejecting documents.

- Comprehensive tracking and insightful reporting on key performance indicators empower analysts with actionable insights and managers with robust control tools.

- Integrated communication panels enable internal and external communications to simplify issue resolution and LoC term finalization.

- The system improves operational workflows by systematically linking documents and records for efficient file organization, storage, and retrieval.

- ClearDox facilitates a comprehensive approach to matching and verifying communications relevant to each LoC, bolstering the integrity of the trade confirmation process.

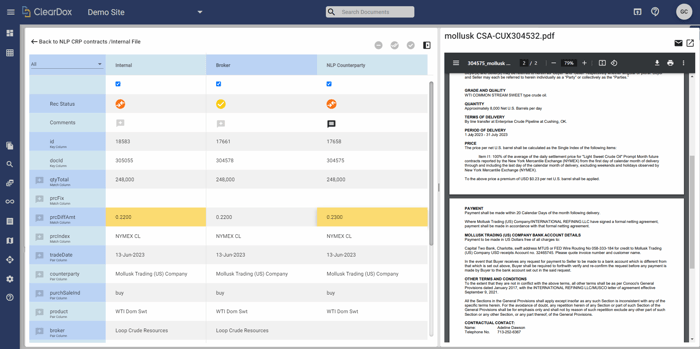

- ClearDox uses a suite of AI technologies including OCR, NLP, and large language models for efficient digitization of documents and extraction of pertinent data.

- The smart digitization process is designed to accommodate the nuances of commodity-specific texts, enhancing the accuracy of information extracted from documents.

- By implementing intelligent digitization, ClearDox enables a swift transition from manual data entry to AI-powered automation, significantly optimizing the trade finance documentation process.

Solution details

SOLUTIONS

Confirmation Manager Solution Sheet

The process of trading confirmations reconciliation is essential to ensure accurate and timely settlement of trades, and to avoid risks and discrepancies that can result in financial losses or legal disputes.

SOLUTIONS

Oil and Gas Solution Brief

Once digitized, broad automated reconciliation efforts including straight through processing, is achievable, freeing resources to focus on higher value activities, and faster response to the next challenge or opportunity.

SOLUTIONS

Before the Next “Black Swan”: Why the Commodities Industry Must Protect Itself With Digitalization

Companies that embrace digitalization will enjoy not only a competitive advantage, but also far greater resilience.

ClearDox FastTrak

Fast Start, Fast Results – 5 weeks, 25 counterparties

1. Gather. Assess. Define.

2 weeks

- Process and data workflows

- Teams impacted

- Counterparties covered (goals prioritized)

- What data matters (sample documents)

- Consume data (normalize dashboards)

- Integration

- Measure impact

2. Design. Adapt/Tune. Validate.

2 weeks

- Design AI-approach for document pipeline

- Adapt and tune models, generate and train new models

- Validate and normalize against commodity semantics knowledge base

3. Activate. Refine. Promote.

1 week

- Activate solutions, integrate workflows

- Continuously monitor quality, refine and optimize

- Promote launch, train team and drive adoption

Next Step: Scale

Scale up – More counterparties / Scale out – New workflows